Market Review - First Quarter 2020

There has rarely been a period in U.S. history when circumstances in our country have changed so dramatically in such a short period of time. Within the span of a few weeks, the economy has transitioned from modest growth to sudden and sharp contraction. Unemployment is expected to reach levels not seen since the Great Depression. Most believe a recovery will occur, but there is considerable uncertainty as to the severity and duration of the downturn as well as the trajectory of growth once the economy begins to recover.

Over the past six weeks, as the number of new COVID-19 cases outside of China began to increase at an alarming rate, equity markets around the world fell sharply. Initially, when it looked as if the virus would be confined to China, the U.S. market continued to rally, with the S&P 500 Index achieving an all-time high on February 19. On that day, there were just 15 known cases in the U.S. As new cases began to surface, stocks and other asset classes began to tumble in what would become a full-blown selling panic. From February 19 to March 23, the S&P 500 experienced it fastest 30% decline in history. For the first quarter, the S&P 500 Index suffered a 19.6% loss; small-cap companies represented by the Russell 2000 Index declined 30.6%. As shown in the table below, each stock index declined by more than one-third from its quarterly high to its low point, with some of the drop having been recovered going into quarter end. Having declined by more than 20%, the S&P 500 and Dow Jones Industrial Average are now considered to be in a bear market. The just-ended bull market was the longest on record, lasting almost 11 years.

The table below shows the performance of major equity indices for selected time periods.

Equity Performance for Periods Ending on March 31, 2020

| Total Return Index | Market Sector | Decline from high to low | Quarter | 1-year | 3-year | 5-year | 10-year |

|---|---|---|---|---|---|---|---|

| S&P 500 | Large U.S. Companies | -33.9% | -19.6% | -7.0% | 5.1% | 6.7% | 10.5% |

| Russell 2000 | Small U.S. Companies | -41.9% | -30.6% | -24.0% | -4.6% | -0.3% | 6.9% |

| MSCI EAFE | Developed Int’l Markets | -34.5% | -22.8% | -14.4% | -1.8% | -0.6% | 2.7% |

| MSCI EM | Emerging Int’l Markets | -34.7% | -23.6% | -17.7% | -1.6% | -0.4% | 0.7% |

Although a recession has not been officially declared, there is no doubt that actions taken to slow the spread of COVID-19 will have a significantly negative impact on the economy. The majority of Americans have been ordered by their state governments to stay at home. Numerous businesses, including retail stores, restaurants, theaters, gyms, and hotels have temporarily closed. To offset revenues lost due to mandated restrictions on nation-wide commerce, the federal government has recently approved fiscal programs totaling $2.2 trillion to provide support to businesses and individuals. The Federal Reserve has equally gone “all in” on its monetary policy response, too. It is providing multiple liquidity programs to preserve functioning credit markets and has lowered short-term interest rates to zero to provide cheaper and more abundant capital to businesses and consumers.

The virus is also having an indirect effect on many other significant industries. When the Chinese economy slowed, it purchased less imported oil, causing global oil prices to fall. Saudi Arabia then tried to convince other members of the OPEC cartel and major non-OPEC oil producing countries (mainly Russia) to agree to supply cuts with the goal of bringing better supply-demand equilibrium and price stabilization to the world market. Russia decided not cooperate with lowering production quotas. In response, Saudi Arabia retaliated by significantly lowering their oil prices and increasing production, causing worldwide energy prices to drop dramatically to levels that will result in losses for many energy companies, including those in the U.S. Consequently, banks that lend to energy companies could face a higher level of defaults.

The duration of the economic downturn and the quickness of the recovery is difficult to forecast. It will depend on individuals’ compliance with stay at home mandates and social distancing recommendations, the ability of our healthcare system to respond to increased rates of infection, the availability of sufficient medical supplies and equipment, and the speed and success in the development of new diagnostic tests and treatments. Since the virus is likely to reemerge in the future, the development of a vaccine will be crucial. The recovery will also depend on the success of the monetary and fiscal programs provided by the federal government and its capacity to make the necessary adjustments as new issues surface. Corporations will need to find ways to conduct business efficiently through disruptions which are likely to continue for the foreseeable future. This likely means a combination of providing tools for remote work and supplying ample protective equipment and other resources to those who must continue to report to work. The ability of companies both large and small to expediently and fully restore their operations when the virus subsides will dictate the speed of the economic recovery.

Early in the quarter, stock market investors’ major concerns were focused on trade war issues and the implications for various market sectors if Bernie Sanders was able to win the Democratic Presidential nomination and deliver on his campaign promises. The risk related to a pandemic was not considered significant just six weeks ago. The primary concern related to COVID-19 at the time was that some U.S. companies were experiencing supply chain disruptions due to China’s shut-down in response to the virus.

The COVID-19 pandemic seems to meet the true definition of a Black Swan event in that it was either broadly unforeseen or was otherwise written off as a threat so remote it was not worth the cost of preparation. For the past 15 years, the World Economic Forum has published a Global Risk Report which attempts to identify and rank the most significant risks to the global economy. The report reflects the opinions of global government, business, and academic leaders, including heads of state and corporate CEOs. The survey published in January of this year asked the leaders to rank various risks to the global economy in terms of likelihood and impact. Of the 30 risks ranked in order of likelihood, infectious diseases ranked 26th. (If a pandemic were to occur, they estimated it would rank 10th in terms of economic impact.) These leaders assigned a higher likelihood to natural disasters, man-made environmental disasters, cyber-attacks, information infrastructure breakdowns, asset bubbles, and financial crises. In the 2007 report, issued just months before the global financial meltdown began, the risk of a financial crisis was tied for the least likely risk to occur. The annual risk reports seem to prove that it is virtually impossible to forecast the future with any degree of certainty. Unfortunately, the next major crisis is also not likely to be anticipated.

Stock prices react to negative events and the uncertainty that they produce. In the 93 years since the inception of the S&P 500 Index, there have been four major declines that exceeded 50%. After each decline, stocks recovered to new highs. While bear markets are painful to endure, they generally provide significant opportunities for long-term investors to take advantage of more attractive prices.

While there is currently very little visibility regarding the next several months, we feel confident that the economy should make a full recovery over time. We acknowledge that some businesses and industries will suffer permanent damage, while others are likely to benefit from changes that society will implement. In the short term, stocks are expected to remain highly volatile until there are clear signs that the impacts of the virus are being contained or mitigated. However, we point to two indicators that stock prices should eventually turn higher.

There are multiple indicators of investor sentiment which reflect whether investors are bullish, bearish, or neutral. The weekly survey conducted by the Association for Individual Investors indicates that currently 52.1% of its members are bearish, compared to the historic average of 30.5%. This is the third consecutive week that bearish sentiment has exceeded 50%. The last time this occurred was in March 2009, which was the month the stock market bottomed during the previous bear market. As you can surmise, this is a contrarian indicator—just as folks start to feel like things will never get better—they do. In the past, extreme pessimism by investors has been indicator of a market bottom and is regarded as a bullish signal. But, it is also important to note that every bear market is different and its timing to recovery is elusive. While we cannot predict the turning point for the stock market, we can strive to hold strong companies with competitive advantages, reasonable valuations, and business models which can sustain a prolonged economic shutdown. We believe holding such companies will create long-term positive returns in our managed portfolios regardless of market timing.

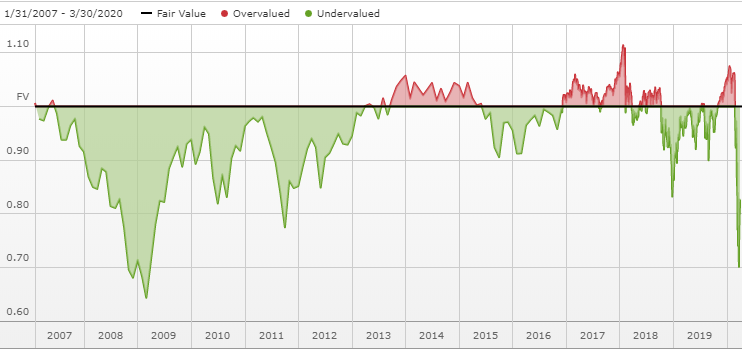

During periods of panic and speculation, stocks prices often do not reflect the true value of companies. They are more reflective of the emotions of investors. With the recent market decline, we believe valuations of companies have become more attractive. Morningstar, an independent investment research firm, publishes a ratio that we believe is a very good indicator of overall market valuation. Morningstar asks its analysts to assign a fair value to each company that they follow. It then calculates a ratio of stock price to fair value for all companies in its coverage. Below is a chart showing the history of this indicator since its inception.

Currently, the ratio of stock price to fair value is 0.70, indicating that Morningstar analysts estimate that the median stock in its universe of coverage is trading 30% below its fair value. The chart indicates this to be the most attractive valuation since the bottom of the last bear market in March 2009. We also note that each previous dip below 0.85 has represented an attractive opportunity to purchase stocks for long-term investors.

We fully expect the next month or so to be very difficult on many levels. In addition to the financial ramifications and the restrictions on our normal lives, we all face the possibility that we, or a family member, could become seriously ill with the virus. The number of new cases and deaths in the U.S. and across the globe is not expected to peak for at least several weeks. There is a likelihood that the news will continue to get worse before it gets better, and there is a possibility that markets could decline further before they recover. However, we are optimistic that by the end of this quarter there will be signs that we have all found ways to cope with the circumstances—and the companies in our portfolios will too. As businesses find ways to work around the constraints imposed on them, we will see evidence that a recovery has begun and life will gradually return to normal.

We wish you and your family good health during this difficult time.

John D. Frankola, CFA Lawrence E. Eakin, Jr. Matthew J. Viverette

Vista Investment Management, LLC is a Registered Investment Advisory firm. Under no circumstances does this article represent a recommendation to buy or sell stocks. This article is intended to provide information and analysis regarding investments and is not a solicitation of any kind. References to historical market data are intended for informational purposes; past performance cannot be considered a guarantee of future performance. Neither the author nor Vista Investment Management, LLC has undertaken any responsibility to update any portion of this article in response to events which may transpire subsequent to its original publication date.