Market Review - Third Quarter 2021

Equities struggled in September as increased political, social, and monetary policy risks led to mixed results for the third quarter. The S&P 500 Index generated total returns of just 0.6%, while most other major equity indices suffered declines. In the last three months, stock prices reacted to rising COVID-19 cases, regulatory clamp downs on specific assets and industries in China, and proposals for dramatic changes to U.S. fiscal policy. Corporate earnings were strong and exceeded analyst expectations. Large companies generally outperformed mid and small-cap companies, which tend to be more sensitive to the overall health of the economy. Apprehension caused by the outbreak of the Delta variant nudged investors again toward technology-focused growth stocks and away from value stocks whose performance are more directly dependent on the reopening of the economy. Investors were also sensitive to Federal Reserve announcements, looking for signals related to tapering its asset purchase program and the timing of eventual interest rate hikes.

The table below shows the performance of major equity indices for selected time periods.

Equity Performance for Periods Ending on September 30, 2021

| Total Return Index | Market Sector | Quarter | YTD | 1-year | 3-year | 5-year | 10-year |

|---|---|---|---|---|---|---|---|

| S&P 500 | Large U.S. Companies | 0.6% | 15.9% | 30.0% | 16.0% | 16.9% | 16.6% |

| Russell 2000 | Small U.S. Companies | -4.4% | 12.4% | 47.7% | 10.6% | 13.5% | 14.6% |

| MSCI EAFE | Developed Int’l Markets | -0.5% | 8.3% | 25.7% | 7.6% | 8.8% | 8.1% |

| MSCI EM | Emerging Int’l Markets | -8.1% | -1.3% | 18.2% | 8.6% | 9.2% | 6.1% |

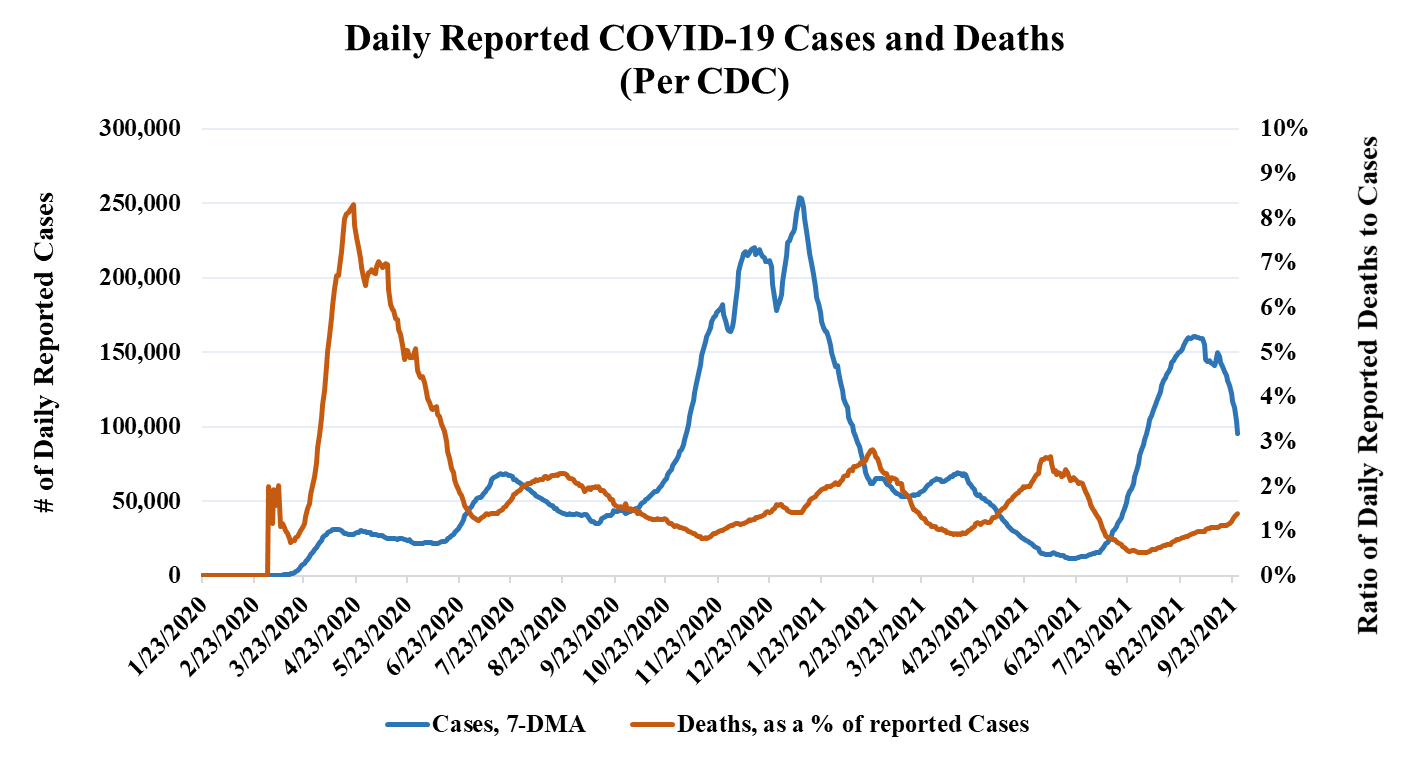

Much like the preceding 18 months, U.S. financial markets were primarily influenced by investors’ sentiment on COVID-19. According to the CDC, the most recent wave peaked around September 1, logging a 7-day moving average for new daily cases of 160,712—levels of infection not seen since January of 2021. It is estimated that approximately 99.0% of new cases are of the Delta variant, up from 35.6% late in the second quarter. The Delta variant is about twice as contagious as previous variants and there is no telling what future variants may arise. Therefore, we continue to view the success of the vaccination campaign as paramount to the battle against COVID-19. Though perhaps at a pace slower than one might expect from a developed nation, the national vaccination rate has steadily increased over the last three months, from about 47.5% to 55.6%. This figure includes children under the age of 12, who are not yet eligible for vaccines. There are many hurdles to achieving widespread immunity across the population, but increased vaccination rates among the youth is especially crucial. While no COVID-19 vaccine is currently approved for children under 12, experts predict emergency authorization from the FDA to come by the end of October. Between increased inoculation among the unvaccinated and the natural immunity developed by survivors of the latest outbreak, officials are cautiously optimistic that the pandemic will be in permanent decline. The COVID-19 Scenario Modeling Hub (a consortium of advisors to the CDC) now predicts a more than 90% decrease in infections through early spring of 2022, assuming childhood vaccinations and no new variant. While many factors remain uncertain, we are optimistic that the COVID-19 virus is not likely to cause significant economic disruptions in the foreseeable future.

Source: Centers for Disease Control and Prevention (CDC)

In our last quarterly letter, we detailed the exceptionally strong earnings performance in the first quarter of 2021, and the extremely high earnings expectations for the second quarter (61.5% growth, compared to the prior year). Following the trend of recent quarters, S&P 500 companies greatly exceeded forecasts. The blended earnings growth rate in the second quarter was 90.9%, the highest in 12 years; 87% of companies beat analyst earnings and revenue expectations, with the strongest outperformance coming from communication services and technology companies. Wall Street analysts now forecast 27.6% earnings growth for the third quarter. It is important to keep in mind these eye-popping growth rates are compared to figures from 2020, when many businesses almost entirely halted operations. What is perhaps more impressive is that S&P 500 earnings for 2021 are forecast to exceed 2019’s record results by 23.0%. We remain positive on the operating environment for publicly traded corporations, but certain risks with the potential to degrade profit margins do exist, such as operating cost inflation and supply chain delays.

Even with the strong earnings rebound in 2021, stock market prices have risen faster than earnings, resulting in higher valuations, especially for large companies. According to Yardeni Research, the S&P 500 trades at a forward price-to-earnings (P/E) ratio of 20.7, well above the trailing five-year average of 18.3 and ten-year average 16.4. Though this index is a useful gauge for the overall U.S. stock market, it is important to understand that it is a market-value-weighted index, meaning that the largest companies have the greatest influence. Analyzing different indices provides a very different view of the relative value of U.S. stocks. Small companies, as measured by the S&P 600, currently trade at a P/E ratio of 15.5 and mid-size companies, as measured by the S&P 400, trade at 16.3. With interest rates still at historically low levels, we regard large U.S. equities as reasonably priced, but view small and mid-size companies as more attractively valued.

Equity performance in the emerging markets was dramatically weaker than in the U.S. The MSCI Emerging Markets Index fell by 8.1% during the third quarter, largely driven lower by uncertainty in China. While underlying growth in China is still strong (Goldman Sachs forecasts a 7.8% increase in GDP for 2021), Chinese companies now find themselves operating in an increasingly harsh regulatory environment. Historically, the Chinese Communist Party has been reluctant to hamstring domestic companies, given the integral role they play in economic expansion. But the past year has marked a period of sweeping regulation, often targeted at the companies producing the strongest secular growth and those most popular among international investors. The full scope of the financial impact is unclear, but many corporations already face large fines, diminished addressable markets, restrictions on financial leverage, and forced delisting on foreign exchanges. Some of the most impacted industries have been technology, real estate, gaming, and for-profit education. While regulatory burdens certainly can undercut profitability, appropriate oversight of companies is attractive in opaque foreign markets, particularly in the emerging markets. Currently, emerging market companies are selling at steep discounts compared to their developed market counterparts. As such, we continue to regard emerging market equities as an attractive component of a diversified portfolio.

The final days of September saw an increase in stock market volatility which has been attributed to the risk of a U.S. government shutdown and a potential default on its debt a few weeks later. Senate Republicans want to force Democrats to raise the debt ceiling as part of the budget reconciliation process, which could take weeks and require close coordination and agreement between Democrats in the House and Senate—agreement that currently does not exist given the size and scope of the ambitious $3.5 trillion appropriations bill being proposed by House Democrats to advance their “social infrastructure” agenda, which includes health care, child care, paid family leave, climate change, and significant tax policy changes. In addition to risking a debt ceiling crisis, the differing priorities among moderate and progressive Democrats is also threatening to derail the bipartisan infrastructure bill which passed in the Senate earlier in the quarter. Higher taxes for corporations and high-income individuals have been proposed to pay for about three quarters of the $3.5 trillion of increased spending over ten years. Equity and fixed income markets seem to have reacted negatively, whether to higher taxes and the increase to the national debt, or to the general dysfunction of our government as this process plays out.

Long-term interest rates rose modestly during the third quarter, with the yield on the 10-year Treasury bond increasing from 1.44% to 1.54%. Interest rates rose sharply following the September Federal Open Market Committee meeting. For many months, Fed officials have slowly introduced the idea of “tapering” (reducing monthly purchases of $120 billion in Treasury bonds and mortgage-backed securities), while withholding specifics to avoid spooking equity investors. This tightrope walk continued during the latest meeting, where Fed Chairman Jerome Powell made no official tapering start date announcement but indicated the bond purchase program may be completed by mid-2022. (Most analysts expect an official start date to be announced at the November meeting.) As for the target federal funds rate (the direct tool used by the Federal Reserve to dictate interest rates), 9 of the 18 FOMC members expect an increase before the end of 2022, and 15 expect an increase by 2023. Tapering and federal funds rate increases are a promising sign of an improving economy, but both could have a negative effect on stock prices in the short term. Generally, these monetary tools increase fixed income yields, which makes safe investments like bonds more attractive and riskier investments like stocks less attractive.

The S&P 500 experienced a 5.1% decline from its all-time high during the month of September. While corrections of any magnitude can be unnerving for investors, we note that this was the first decline of more than 5% since last October. According to Barron’s, it was the seventh-longest streak on record without a 5% correction. Despite the current uncertainties which have produced recent market weakness, we continue to believe that equities are the most attractive asset class looking out over a 5-year time horizon. Our diversified approach to equities, including exposures to different size companies, all major industry sectors, and developed and emerging international markets, is intended to produce attractive returns in many market scenarios on a risk-adjusted basis. We continue to hold a cautious stance on the fixed income markets as we see risk related to rising interest rates as the global economy continues to recover. To minimize this risk, we have primarily utilized fixed income investments with shorter-term maturities.

The return of fans to football stadiums this fall has been one of the most obvious signs that American life is returning to normal. At the same time, many hospitals are still struggling with ICUs that are at capacity with COVID-19 patients. We are not yet at the end of the tunnel, but going forward our view seems to be getting brighter.

John D. Frankola, CFA Lawrence E. Eakin, Jr. Matthew J. Viverette

Vista Investment Management, LLC is a Registered Investment Advisory firm. Under no circumstances does this article represent a recommendation to buy or sell stocks. This article is intended to provide information and analysis regarding investments and is not a solicitation of any kind. References to historical market data are intended for informational purposes; past performance cannot be considered a guarantee of future performance. Neither the author nor Vista Investment Management, LLC has undertaken any responsibility to update any portion of this article in response to events which may transpire subsequent to its original publication date.