Market Review - First Quarter 2022

One of the core tenets of our investment management process is that it is not possible to predict the short-term direction of financial markets. To do so would require not only the ability to foresee future events, but also to accurately predict how investors will react to them. Just as the global COVID-19 pandemic was unforeseen, the invasion of Ukraine by Russia in the first quarter of 2022 was shockingly unexpected. Fears about the economic impact of the COVID-19 virus caused more than a 30% decline in major stock indices in early 2020. Similarly, the Russian invasion initially led to a 13.0% correction in the S&P 500 and even larger losses in other U.S. and global stock indices. The S&P 500 has since recovered about two-thirds of that decline, but the full extent of the economic consequences of war in Europe have only started to play out, and unlike the pandemic, it’s not clear what needs to happen to end this crisis.

The S&P 500 index lost 4.6% in the first quarter of 2022, with most other stock indices suffering greater losses. As Ukrainian armed forces demonstrated strong resistance to the Russian advance and corporations took stock of how sanctions would impact their businesses, stock markets generated positive performance in March, helping to reduce earlier losses.

Inflation concerns, rapidly rising interest rates, and higher energy costs also contributed to the weak first quarter performance for both equities and fixed income markets. During the quarter, the U.S. inflation rate spiked to a 40-year high and the interest rate on the benchmark 10-year Treasury note rose from 1.51% to 2.33%. The sharp increase in interest rates resulted in losses across the fixed income market.

The table below shows the performance of major equity indices for selected time periods.

Equity Performance for Periods Ending on March 31, 2022

| Total Return Index | Market Sector | Quarter | 1-year | 3-year | 5-year | 10-year |

|---|---|---|---|---|---|---|

| S&P 500 | Large U.S. Companies | -4.6% | 15.7% | 18.9% | 16.0% | 14.6% |

| Russell 2000 | Small U.S. Companies | -7.5% | -5.8% | 11.7% | 9.7% | 11.0% |

| MSCI EAFE | Developed Int’l Markets | -5.9% | 1.2% | 7.8% | 6.7% | 6.3% |

| MSCI EM | Emerging Int’l Markets | -7.0% | -11.4% | 4.9% | 6.0% | 3.4% |

Late last year, the U.S. disclosed that satellite imagery was showing a massive buildup of Russian troops along the Ukraine border with Russia. By early February, U.S. intelligence warned of a possible Russian invasion, information which was initially dismissed even by the Ukrainian government. Since the Russian invasion and annexation of the Ukrainian peninsula of Crimea in 2014, Ukraine had developed a tolerance for Russian harassment and its support of pro-Russian separatist groups in eastern Ukraine.

On February 24, Russia invaded Ukraine with the intention of taking the capital of Kyiv within days, overthrowing the democratically elected leadership, and installing a pro-Russian government. The immediate response of the West was to provide defensive weapons and humanitarian aid to Ukraine while at the same time penalizing Russia with significant economic sanctions.

In the six weeks since the war started, Ukraine has surprised the world with its defensive capabilities, forcing a military stalemate on the ground with Russia. The death and destruction caused by Russia’s unprovoked invasion has saddened us all. At this point, it seems impossible to predict how and when the war will end.

Although the stock market has declined and volatility has increased, the impact of the war in Ukraine on the U.S. economy has not been severe. Russian and Ukraine GDP amounts to less than 3% of global GDP and has an even smaller effect on the earnings of U.S. companies. However, because Russia and Ukraine are large exporters of energy, raw materials, and food, the war and related sanctions will be disruptive for specific industries and a number of countries, particularly in the Eastern Hemisphere. The most significant impacts on U.S. companies are likely to be higher costs related to energy and finding alternate sources for some raw materials. Companies who are unable to fully pass these costs on to their customers could see profit margins shrink. We do not expect to see a major downward revision in U.S. corporate earnings related to the war, but we intend to follow management commentary in upcoming earnings calls which may shed light on the challenges facing firms in this new environment.

On the other hand, the Western sanctions are likely to have a significant effect on Russia, and developing energy independence from Russia will be a challenge for several European countries. For example, Germany recently abandoned plans to use a $10 billion, 1,200-mile pipeline—“Nord Stream 2”—which would have carried natural gas from Russia. If it were put into operation, this pipeline would have doubled Germany’s natural gas imports from Russia. In a complete reversal of policy, Germany announced it would stop all imports of natural gas from Russia by the end of 2024. The long-term effect on the European economy of cutting trade with Russia will largely be dependent on how quickly it is able to replace Russian energy with other global sources.

Constraints in the global energy market come at a difficult time for the U.S. as the Federal Reserve attempts to slow inflation. The cost of a barrel of oil increased by 33% during the first quarter of 2022, and the price of natural gas rose by 58%. The U.S. inflation rate, as measured by the Consumer Price Index (CPI), is 7.9%, its highest reading since January 1982. This led the Federal Reserve to begin raising its benchmark interest rate by 0.25% in March. By increasing interest rates, the Fed is attempting to execute an important but delicate balancing act to relieve some of the inflationary forces without slowing the economy too much.

While the Fed attempts to influence the direction of interest rates, there are times when market forces have greater impact. During the quarter, other interest rates not directly controlled by the Fed rose sharply. This sharp response by the market has historically indicated that the Fed may be “behind the curve” or too slow with policy in addressing inflation. The interest rate on the 10-year Treasury note rose from 1.51% to 2.33%. A rapid increase in interest rates typically produces declines in fixed income securities. The Bloomberg Aggregate Bond Index suffered a 5.9% loss during the quarter. This index measures the performance of all investment grade taxable bonds in the U.S. The bonds in this index have an average maturity of 8.5 years. Even shorter-term bonds performed poorly, due to the dramatic increase in short-term rates. During the quarter, the interest rate on the 2-year Treasury note increased from 0.73% to 2.35%. Although fixed income performance was negative in the first quarter, if interest rates stabilize at current levels, higher rates should produce more attractive returns for fixed income investors going forward.

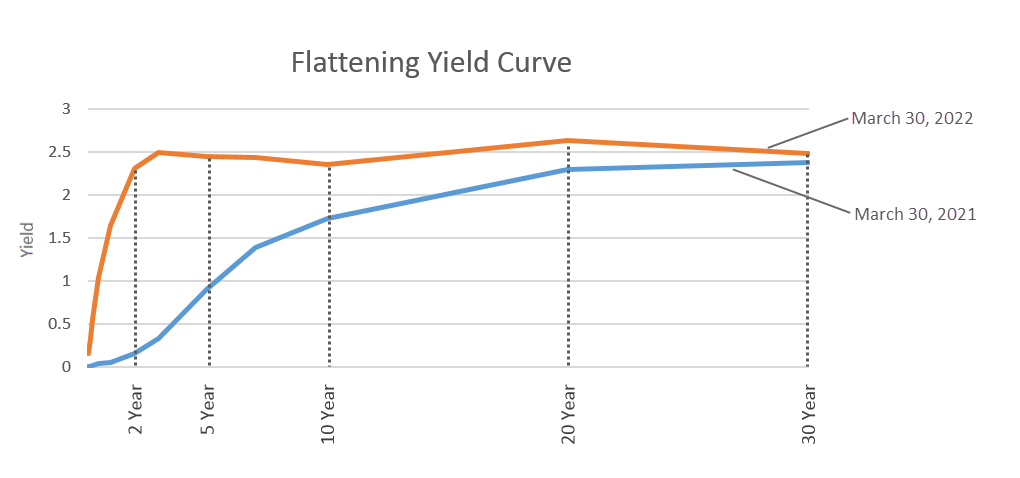

The sharp market response to rising rates has led to a flattening yield curve—a concerning signal to some investors. The following graph shows the current yield curve and the curve from one year ago.

Interest rates reflect the compensation lenders demand to loan money to borrowers. The rates take account of a variety of factors: the likelihood that the lender will be paid back, anticipated future inflation, demand for loans by borrowers, monetary policy, and fiscal policy. During most periods of economic growth, the yield curve is typically upward sloping with long-term rates considerably higher than short-term rates. When the yield curve flattens (or even inverts) some market observers see it as a sign that the economy is weakening and that a recession could be on the horizon. This pattern has been observed prior to previous economic downturns, but it is not always predictive. The flattening curve may reflect that long-term bond investors anticipate weak future economic conditions compared to the current environment. Some have argued against this logic, suggesting that other factors such as the Fed’s pandemic bond buying program or price relationships between U.S. bonds and foreign bonds carrying lower interest rates have distorted normal demand for the 10-year note, resulting in a relatively low yield.

While the flattening yield curve may indicate negative sentiment among bond investors, most leading economic indicators are still pointing toward continued strong growth over the next year. The Federal Reserve’s survey of professional forecasters is currently predicting GDP growth in the U.S. of 3.7% for 2022. In March, the unemployment rate declined to 3.6%, almost matching the 50-year low of 3.5% achieved in early 2020.

According to FactSet, earnings for the companies comprising the S&P 500 Index are expected to increase 4.7% in the first quarter of 2022 and 9.5% for the full year. The price-to-earnings ratio of the S&P 500 is currently 19.5, modestly higher than 5 and 10-year averages of 18.6 and 16.8, respectively. This indicator puts stocks at the high end of a fairly-priced range. While valuation, inflation, and interest rates will play a role in near-term stock price performance, the situation in Ukraine will likely have the greatest influence. Investors remain focused on the war in Ukraine primarily due to the risk of escalation and the consequences it could have. The use of chemical or tactical nuclear weapons, an incursion on other former Soviet states, or a provocation that pulls NATO and the U.S. into war would likely cause declines in equity markets.

In many respects, the current situation in the world is similar to two years ago. Back then, a virus was causing death and suffering with no end in sight. A global pandemic was occasionally used as a plot for a science fiction movie, but it wasn’t appreciated as a real risk by most people. Today, war in Europe is causing death and suffering with no end in sight. The destruction in Ukraine, the scorched-earth tactics of the Russian military, the deranged ambitions of ruthless dictator, the threat of the use of nuclear weapons, and the possibility of World War III are equally unimaginable, but they are risks that must be weighed by investors.

While we do not wish to understate the gravity of the crisis in Ukraine, we feel it is important to acknowledge that the fighting has remained relatively contained within Ukraine and Russia. We are inspired by the coordinated condemnation of Russia’s actions and feel that it is a reason for optimism. Just as civilized people around the world cooperated and made sacrifices to constrain COVID-19, now too they will work to restore peace, hold Russia accountable, and help the people of Ukraine rebuild their lives and their country. We anticipate continued market volatility until there is greater clarity on how this will be achieved, but despite the volatility, we believe our economy and markets will continue to prosper over the long term.

John D. Frankola, CFA Lawrence E. Eakin, Jr. Matthew J. Viverette

Vista Investment Management, LLC is a Registered Investment Advisory firm. Under no circumstances does this article represent a recommendation to buy or sell stocks. This article is intended to provide information and analysis regarding investments and is not a solicitation of any kind. References to historical market data are intended for informational purposes; past performance cannot be considered a guarantee of future performance. Neither the author nor Vista Investment Management, LLC has undertaken any responsibility to update any portion of this article in response to events which may transpire subsequent to its original publication date.