Market Review - Fourth Quarter 2022

Equities staged a modest recovery in the fourth quarter of 2022, but it was not enough to offset the sharp decline experienced in the first nine months of the year. The S&P 500 generated total returns of 7.6% for the fourth quarter but netted a loss of 18.1% for all of 2022. While many market participants now expect a recession, the fourth quarter rally reflected growing optimism that inflation was moderating. This sentiment was supported by smaller increases in the Consumer Price Index and the Federal Reserve hiking interest rates at a slower pace in December than what it earlier signaled.

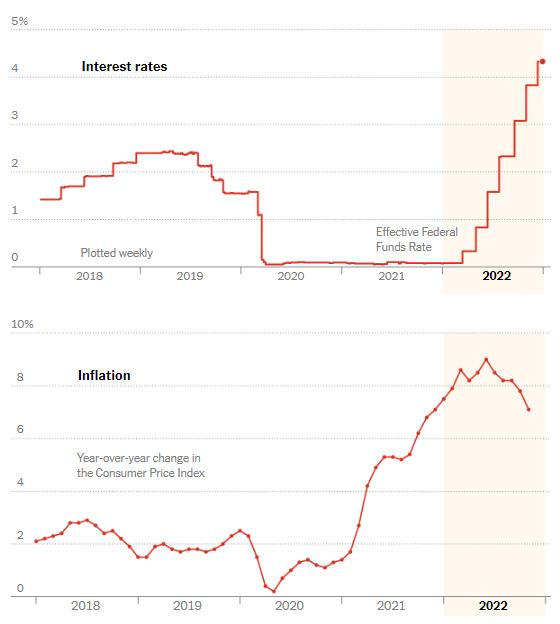

Most investors expect the economy to slow primarily because the Federal Reserve has aggressively increased interest rates in order to curtail inflation. Higher interest rates discourage borrowing by consumers and businesses, consequently reducing demand which should result in lower prices when supply remains constant. The adjacent two graphs show the changes in the Fed’s benchmark interest rate and inflation over the past five years. The Fed lowered interest rates to 0% to stimulate the economy in 2020 following the pandemic shutdown and then increased rates to slow the economy in 2022, in reaction to very high levels of inflation. The Fed has indicated its goal is to produce a “soft landing”—that is, slow the economy, bring inflation below 3%, and avoid a recession. The second graph indicates that inflation, as measured by the CPI, appears to have peaked. Other inflation indicators, lead us to believe this trend should continue into 2023.

Sources: Bureau of Labor Statistics; Federal Reserve Bank of St. Louis

Over the course of the year, numerous indicators pointed to the likelihood that a recession had begun (or would begin shortly). Most of the components of the Conference Board Leading Economic Index are now signaling a weakening economy. These include lower building permits, weakness in manufacturing orders, and an inverted yield curve (short-term interest rates are higher than long-term rates). This index has declined 2.7% year-over-year. In the six previous times since 1960 when the index fell by 2% or more from the previous year, the economy was either in a recession or about to enter one. The Conference Board’s recent survey of 136 CEOs indicated that 98% were preparing for a recession in the next 12 to 18 months, their lowest confidence level since the Great Recession (2007-2009). Surprisingly, employment has remained strong with the unemployment rate currently at 3.7%, near its 50-year low. The Federal Reserve is forecasting unemployment will increase to 4.5% next year, although it has stopped short of predicting a recession.

Fortunately, most recessions are short in duration, and most economic expansions are long. Since World War II there have been 12 recessions in the U.S. They have averaged 10 months in length. The most recent was the shortest (2 months in 2020), and the preceding was the longest (18 months in 2007-2009). Since World War II, economic expansions have averaged over six years in duration with two expansions continuing for 10 years.

The equity market’s near 20% decline from its early January 2022 peak is likely reflecting expectations for an average recession. The balance sheets of consumers and businesses are relatively healthy, and banks are well-capitalized. Much of the speculation produced by the stimulus-induced bull market has eroded in the past year. For example, the collective value of all crypto currencies has fallen by more than 70%. Similar declines have been seen in emerging growth companies, stay-at-home stocks (e.g., Peloton, Roku, Teladoc, Wayfair), meme stocks (e.g., AMC, GameStop), and electric vehicle companies (e.g., Tesla, Lucid, Rivian). We regard the reduction in speculation combined with more realistic growth expectations as positive for the market. While there is a possibility that stocks might decline further, especially if corporate earnings fail to meet expectations, we do not expect a severe or prolonged recession.

Currently, according to FactSet Research, analysts are estimating that companies comprising the S&P 500 will generate revenue and earnings growth in 2023 of 3.3% and 5.3%, respectively. Company valuations appear reasonable, with a forward price/earnings (P/E) ratio of 17.3 compared to the 10-year average of 17.1.

The table below shows the performance of major equity indices for selected time periods.

Equity Performance for Periods Ending on December 31, 2022

| Total Return Index | Market Sector | Quarter | 1-year | 3-year | 5-year | 10-year |

|---|---|---|---|---|---|---|

| S&P 500 | Large U.S. Companies | 7.6% | -18.1% | 7.7% | 9.4% | 12.6% |

| Russell 2000 | Small U.S. Companies | 6.2% | -20.4% | 3.1% | 4.1% | 9.0% |

| MSCI EAFE | Developed Int’l Markets | 17.3% | -14.5% | 0.9% | 1.5% | 4.7% |

| MSCI EM | Emerging Int’l Markets | 9.7% | -20.1% | -2.7% | -1.4% | 1.4% |

In most years when stocks decline in value, returns from fixed income securities help to offset losses. This did not occur in 2022. The Bloomberg Aggregate Bond Index, which tracks the performance of taxable U.S. investment grade bonds, lost 13.0% in 2022. This loss can be attributed to the significant increase in interest rates during the year. During 2022, the yield on the benchmark 10-Year Treasury Note rose from 1.51% to 3.88%.

The 60% equity 40% fixed income portfolio is often viewed as an ideal blend of growth and income for retired investors. This asset allocation has produced positive returns in 83% of the years since 1980 and usually holds up well during corrections. In 2022, the 60/40 asset mix produced a loss of 17.5% when computing returns using the primary benchmarks for each of these asset classes. It was the worst loss in a calendar year for this asset allocation since 1937.

While rising interest rates caused much damage to both equities and fixed income investments in 2022, we believe investors will benefit by staying invested as interest rates return to a level that offers a return that adequately compensates investors for inflation risk.

As we enter the new year, we are reluctant to make many bold forecasts. There are numerous examples of the futility of trying to predict the direction of the market, the economy, or world events. For instance, in January 2020 the World Economic Forum published the Global Risk Report, a survey of academic, political, and business leaders, which ranked infectious diseases as the 26th most likely risk to occur of 30 potential risks listed. Shortly after the report was issued the coronavirus outbreak was declared a pandemic. Another example occurred last year. At the start of the year, there was little concern about a major war in Europe. Yet, Russia’s invasion of Ukraine last February produced incredible suffering for Ukrainians, major disruptions to global food and energy markets, and various other economic and geopolitical implications for numerous countries.

The Federal Reserve has also demonstrated an inability to predict the future. In 2021, they incorrectly described inflation as transitory, expecting it to decline gradually without the need to act. In December 2021, the Federal Reserve members were asked to forecast where the Federal-funds rate would be at the end of 2022. (This survey is commonly referred to as the dot plot, since the Fed publishes a graph showing each estimate from each Fed member as a dot.) The average fed-funds rate of the 18 estimates was 0.93%, with the two highest estimates at 1.25%. They were not even close. The actual fed-funds rate ended 2022 at 4.25% to 4.50%. The average estimate made in December 2022 for the end of 2023 is for a fed-funds rate of 5.34%. This reflects the Fed’s “higher for longer” stance to combat inflation. Considering past errors in forecasting, this estimate should be taken with a grain of salt. We regard a potential Fed policy mistake as one of the major market risks going into 2023. Hopefully, Chairman Powell and the other Federal Open Market Committee (FOMC) members can successfully bring down inflation without causing a severe economic downturn.

Market commentary is big business. There are multiple television channels that you can flip on at any moment to hear speculation related to what actions the Fed will take, how high interest rates will go, whether there will be a recession, how fast inflation will fall, or what the next jobs report will show. Regardless of who is speaking, this commentary is an educated guess at best. Although we take interest in what is happening in the market at any given point in time to gauge consensus thinking, we continue to believe that predicting the market is a fool’s errand. Instead of succumbing to the negative sentiment, we prefer to stay focused on the long term, executing a disciplined strategy of rebalancing, and seeking reasonably valued investments that we believe have the potential to outperform over the next several years or longer.

As we look ahead to 2023, we reiterate that bear markets and recessions have been good times to be invested in equities. Long-term returns measured from these points in the business cycle have been above average. This should make logical sense to most people: when investor sentiment is negative, there are more sellers and fewer buyers. There is less competition as a buyer; fearful investors who have seen their portfolio decline in value are willing to accept less to sell their stock in an emotional attempt to prevent further losses. We are willing to pay fearful investors less for the same stock when the long-term fundamentals and investment thesis haven’t changed. The discipline of rebalancing portfolios to a target asset allocation has us doing just that: incrementally adding to equities when corrections occur. We have tried to position client portfolios to withstand market corrections, minimizing the need to sell equities at multiyear lows, and have advised clients to expect losses in some years. The volatility risk associated with equities provides the justification for the higher long-term returns that this asset class offers.

John D. Frankola, CFA Lawrence E. Eakin, Jr. Matthew J. Viverette

Vista Investment Management, LLC is a Registered Investment Advisory firm. Under no circumstances does this article represent a recommendation to buy or sell stocks. This article is intended to provide information and analysis regarding investments and is not a solicitation of any kind. References to historical market data are intended for informational purposes; past performance cannot be considered a guarantee of future performance. Neither the author nor Vista Investment Management, LLC has undertaken any responsibility to update any portion of this article in response to events which may transpire subsequent to its original publication date.