Market Review - Second Quarter 2023

Equity markets delivered strong returns in the second quarter of 2023 as a number of investors’ concerns lessened. Worries about a possible banking crisis following the collapse of several banks have largely diminished, a possible default of the U.S. government over the debt ceiling was averted, inflation has continued to decline, and the long-anticipated recession has yet to materialize.

Equity Performance for Periods Ending on June 30, 2023

| Total Return Index | Market Sector | Quarter | YTD | 1-year | 3-year | 5-year | 10-year |

|---|---|---|---|---|---|---|---|

| S&P 500 | Large U.S. Companies | 8.7% | 16.9% | 19.6% | 14.6% | 12.3% | 12.9% |

| Russell 2000 | Small U.S. Companies | 5.2% | 8.1% | 12.3% | 10.8% | 4.2% | 8.3% |

| MSCI EAFE | Developed Int’l Markets | 3.0% | 11.7% | 18.8% | 8.9% | 4.4% | 5.4% |

| MSCI EM | Emerging Int’l Markets | 0.9% | 4.9% | 1.8% | 2.3% | 0.9% | 3.0% |

In June, the S&P 500 Index rose to a level that was 20% above its October 2022 low. This advance met the definition of a new bull market and ended the previous bear market. According to Bespoke Research, the bear market lasted 282 days, just shy of the average bear market length of 286 days. The decline during that period was 25.4%, less than the average of 35.1%. Thankfully, bull markets typically have much longer durations than bear markets. Since 1927, the average length of bull markets has been 2.8 years, or 3.5 times longer than bear markets. The average gain during that time was 114.4%. Even with its recent performance through the end of June, the S&P 500 is still 7.2% below its January 3, 2022 all-time high.

The S&P 500 Index is intended to be a broad representation of the U.S. stock market. The total market value of its constituents equals 83% of all publicly traded companies in the U.S. The S&P 500 is a market weighted index, which means that larger companies have a proportionately greater impact on the index performance than smaller companies. The index’s stellar first half performance was skewed significantly by a few of its largest components.

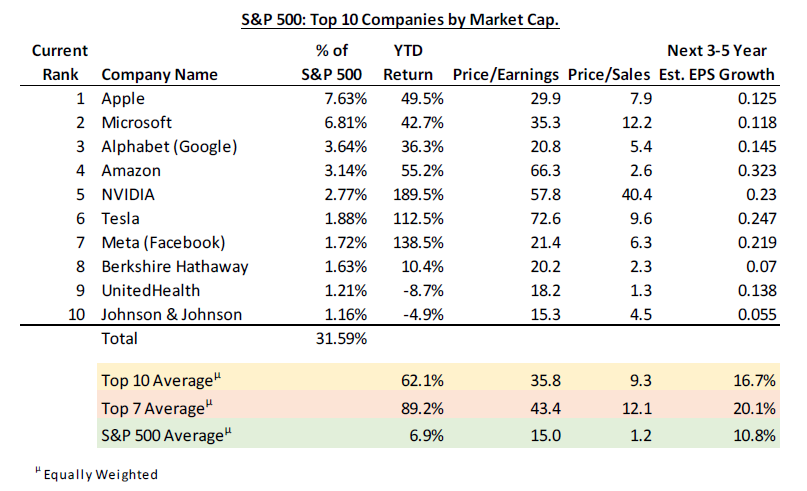

In the first half of 2023, a significant portion of the S&P 500’s performance can be attributed to the 10 largest companies. As shown in the following table, these companies comprised 31.6% of the S&P 500’s market value. The ten companies generated average total returns of 62.1% in the first six months of 2023. Even more amazing was the performance of the top seven companies, which were all linked to the artificial intelligence (AI) boom that has gripped investors since the beginning of the year. As a group, these seven companies had average returns of 89.2%. Many investors believe that artificial intelligence represents the next major technological revolution, similar to personal computers, the Internet, mobile phones, e-commerce, and genetic engineering.

While we do have exposure to a number of these companies, either through direct ownership of their shares or through funds which own them, we have become increasingly cautious as these stocks have become very expensive compared to the average S&P 500 company. While AI is likely to benefit these top seven companies, the positive impacts of AI will be broad and will likely enhance the performance of companies in all industries. The success of AI ultimately hinges on effectively navigating the substantial risks associated with its deployment.

Another dynamic contributing to the high valuations of the largest companies was a “flight to safety” by investors worried about a banking crisis, a threatening U.S. government debt default, and a possible recession. During weak market cycles, the largest, most respected companies often attract investors’ attention since they are thought to be of higher quality with greater earnings stability. At the end of May, all of the then-9.6% year-to-date return for the S&P 500 was attributable to the top seven companies, while the average company in the S&P 500 had a loss of 0.7%. In June, the rally broadened to include smaller companies and a wider range of industry sectors.

New technological advances are known to produce periods of speculative frenzy when stock prices of many associated companies (both good and bad) rise significantly. Further price increases occur as investors chase performance, many with a fear of missing out. But over time, only a few companies end up leading the industry while the weak companies are sorted out, producing significant losses for investors who selected wrong or just got caught up in the speculative hype. By all indications, the AI premium assigned to these large technology companies is excessive and highly speculative.

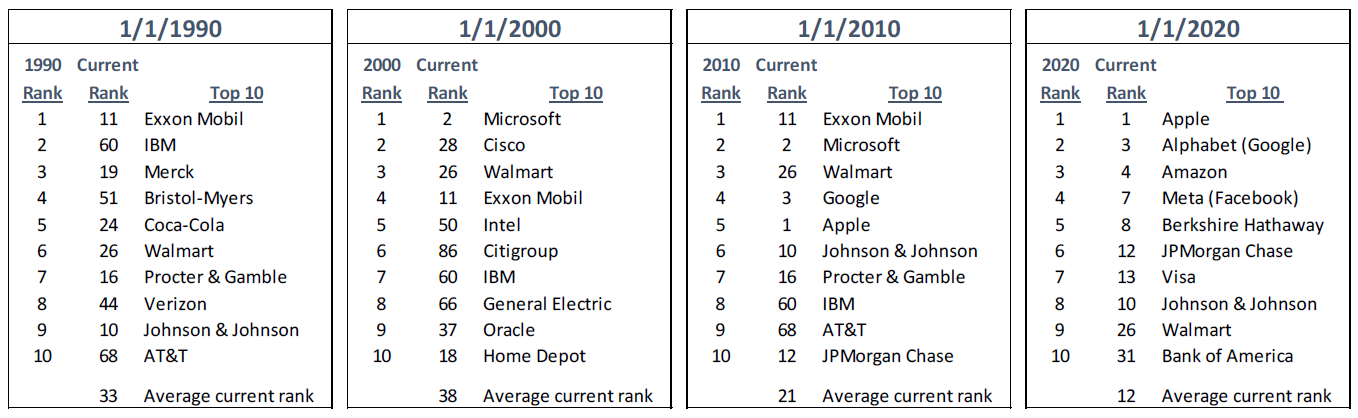

Looking at the ten largest companies at the beginning of each of the last several decades provides some interesting insights.

First, it is difficult for a company to remain in the top 10 over the long term. Businesses are often disrupted by new technologies and competition, even when possessing an almost monopolistic status. Second, many companies achieved their position because of a popular investment trend at that time (e.g. 3 drug companies in 1990, 5 tech companies in 2000) that eventually fades in popularity or relevance. Third, while some stocks on the list will continue to perform well, the majority of top 10 companies are likely to underperform the overall market over the long term. For example, there are four companies in the 2000 Top 10 list that have lower stock prices 23 years later. In other words, their stock prices have fallen whereas the market has increased in value tremendously over the same time period.

We view the market’s current performance as a situation in which a small portion of the market appears to be overvalued—possibly in a bubble—while the rest of the market looks to be very reasonably priced. Since the portfolios we manage are highly diversified by industry and company size, we have exposure to these technology companies, but we have resisted the urge to participate in the frenzy. This limits our exposure in the event that an AI-related bubble were to pop. Furthermore, our broader equity exposure positions client portfolios for the long term.

Recent economic data has also bolstered stock market performance. In late June, the Bureau of Economic Analysis released its final calculation for 2023 first quarter GDP. Surprisingly, GDP rose 2.0% which follows the 2.6% increase in the fourth quarter of 2022. Unemployment remains low at 3.7% and inflation - as measured by the CPI - has declined for 11 consecutive months to 4.0% year-over-year.

Despite some positive economic data, the Conference Board Leading Economic Index declined for the 14th consecutive month and continues to forecast a mild recession. Rising interest rates, lower consumer sentiment, weakening manufacturing orders, an inverted yield curve, and worsening credit conditions are expected to lead to slower economic growth over the next several quarters. Corporate earnings are expected to decline in the second and third quarters but increase on easier comparisons in the fourth quarter. While we acknowledge that a recession may occur, we believe this possibility has already been discounted in the stock prices of most companies. That said, the labor market conditions are inconsistent with a recession. It remains a possibility the highly anticipated recession never happens.

After increasing interest rates by 5% in 10 consecutive meetings to a range of 5.0% to 5.25%, the Federal Reserve finally paused on raising rates at its June meeting. The federal funds rate is now at its highest level since September 2007. The Fed signaled that further increases are likely, and the market anticipates another quarter percent increase in late July. Fed officials are now forecasting that its benchmark rate may need to increase to 5.6% in order to slow the economy and reduce inflation to its 2.0% goal.

During the second quarter, the interest rate on the 10-year Treasury note rose from 3.49% to 3.82%. The increase in interest rates for long-term bonds contributed to a 0.8% loss for the Bloomberg Aggregate Bond Index, which measures the performance of all U.S. investment grade taxable bonds. Most investment-grade corporate bonds and short-term Treasuries are now yielding more than 5%. With both short and long-term interest rates showing substantial increases over the last 18 months, we regard fixed income investments as more competitive with equities on a risk-adjusted basis and we are gradually increasing the average duration of our fixed-income investments.

We would like to see a continued broadening of stock market performance in the second half of 2023, with less speculation in the largest companies and a cooling of the AI frenzy. We believe that equity performance will be primarily influenced by corporate earnings, Fed policy, and the economic outlook. Foreign relations with China and the situation in Ukraine will continue to have an impact on the global economy. Despite near-term uncertainty, we continue to be optimistic about the long term.

John D. Frankola, CFA Lawrence E. Eakin, Jr. Matthew J. Viverette Dylan C. T. Dunlop

Vista Investment Management, LLC is a Registered Investment Advisory firm. Under no circumstances does this article represent a recommendation to buy or sell stocks. This article is intended to provide information and analysis regarding investments and is not a solicitation of any kind. References to historical market data are intended for informational purposes; past performance cannot be considered a guarantee of future performance. Neither the author nor Vista Investment Management, LLC has undertaken any responsibility to update any portion of this article in response to events which may transpire subsequent to its original publication date.