Market Review - Third Quarter 2023

Most major equity and fixed income indices lost ground in the third quarter of 2023. After raising the Federal Funds rate by 0.25% in July to a range of 5.25% to 5.50%, the Federal Reserve kept its target rate steady at its September meeting. However, the Fed indicated that rates are likely to remain higher for longer than previously anticipated. While there has been significant progress on reducing inflation from its recent peak, the Fed indicated it might need to increase rates further in order to lower inflation to its 2% target. Higher interest rates are intended to slow the economy and reduce the demand for goods and services, therefore, reducing pressure on prices. While lower inflation in the future should be positive for the economy, rising interest rates are perceived as negative in the short term for both fixed income and equity markets.

Equity Performance for Periods Ending on September 30, 2023

| Total Return Index | Market Sector | Quarter | YTD | 1-year | 3-year | 5-year | 10-year |

|---|---|---|---|---|---|---|---|

| S&P 500 | Large U.S. Companies | -3.3% | 13.1% | 21.6% | 10.2% | 9.9% | 11.9% |

| Russell 2000 | Small U.S. Companies | -5.1% | 2.5% | 12.3% | 7.2% | 2.4% | 6.6% |

| MSCI EAFE | Developed Int’l Markets | -4.1% | 7.1% | 18.8% | 5.8% | 3.2% | 3.8% |

| MSCI EM | Emerging Int’l Markets | -2.9% | 1.8% | 1.8% | -1.7% | 0.6% | 2.1% |

| BB US Agg Bond | US Investment Grd Bonds | -3.2% | -1.2% | 0.6% | -5.2% | 0.1% | 1.1% |

During the third quarter, the yield on the 10-year Treasury Note rose from 3.82% to 4.57%. The Bloomberg US Aggregate Bond Index, the broadest measure of the US taxable bond market, lost 3.2%. Interest rates and bond prices have an inverse relationship; when interest rates rise, existing bonds decline in value. This is because previously issued bonds with lower interest rates are less attractive than newly issued bonds with higher rates. The adjacent chart depicts the increase in the 10-Year Treasury Note interest rate over the past 10 years. As noted in the preceding table, the recent sharp increase in rates has significantly reduced returns for most bond investors. We continue to position the portfolios we manage with shorter-term fixed income securities to reduce the risk related to further increases in interest rates and to take advantage of higher short-term yields.

Equity markets have also suffered due to rising interest rates. When interest rates rise, the cost of borrowing for businesses and consumers increases, leading to lower spending and potentially reducing corporate profits. Also, companies that are issuing new debt to finance operations will experience higher interest expense. In addition, higher interest rates make fixed income investments more attractive compared to stocks, causing some investors to shift their money away from stocks.

While the S&P 500 declined by 3.3% in the third quarter, it continues to show double digit returns for the year-to-date period. The 2023 returns of the S&P 500 have been driven primarily by the 10 largest companies, which now comprise 34.0% of the S&P 500’s market value. The average year-to-date price increase for these 10 companies is 72.2%. The average price change for the remaining 490 companies in the S&P is just 0.8%. The largest 10 companies have advanced on speculation that most of them will be beneficiaries of artificial intelligence deployment. Many investors also consider them less sensitive to rising interest rates, as well as safe havens in a volatile market. As a group, they appear to be overvalued, with an average price-to-earning (P/E) ratio of 26.8, compared to 14.0 for the rest of the S&P 500. We have exposure to some of these large companies in the portfolios that we manage, but it is significantly less than their weighting in the S&P 500. We have some concern that these companies could experience future weakness if they are unable to meet the high expectations to deliver on artificial intelligence.

At the end of the third quarter, major financial markets ended substantially below their all-time highs. The S&P 500, the Russell 2000, and the Bloomberg US Bond indices closed at 11.6%, 26.9%, and 15.6%, respectively–below their peak levels.

The economy continues to grow modestly, despite pockets of weakness. The Federal Reserve is projecting 2.1% real GDP growth for 2023. Employment remains quite strong, with the unemployment rate currently at 3.8%, compared to the long-term average of 5.7%. However, the Conference Board Leading Economic Index declined in August for the 17th straight month. The yield curve, which has been inverted (short-term interest rates have been higher than long-term rates) since July 2022, is predicting that economic growth will likely slow. The Federal Reserve interest rate policy is intended to slow the economy without triggering a recession–“a soft landing.” So far, the Fed has been successful in lowering inflation, but inflation remains well above the target rate. The process has taken longer than many investors had hoped, and it has been somewhat painful for investors and parts of the economy.

While our discussion has focused mostly on interest rates, numerous other important factors may come into play in the near term. After going to the brink in May and again in September, Congress needs to pass a budget and address the Federal deficit. Presidential politics are likely to influence markets; historically, returns in the third and fourth year of the presidential cycle have significantly exceeded the returns of the first two years. Inflation needs to continue to decline, which will allow the Fed to ease up on its high interest rate policy. (The Fed is forecasting that inflation will decline to 2.5% for 2024 and 2.2% for 2025.) Geopolitical concerns regarding the war in Ukraine, risk of cooperation between Russia, Iran, and North Korea, as well as tensions between the US and China need to subside.

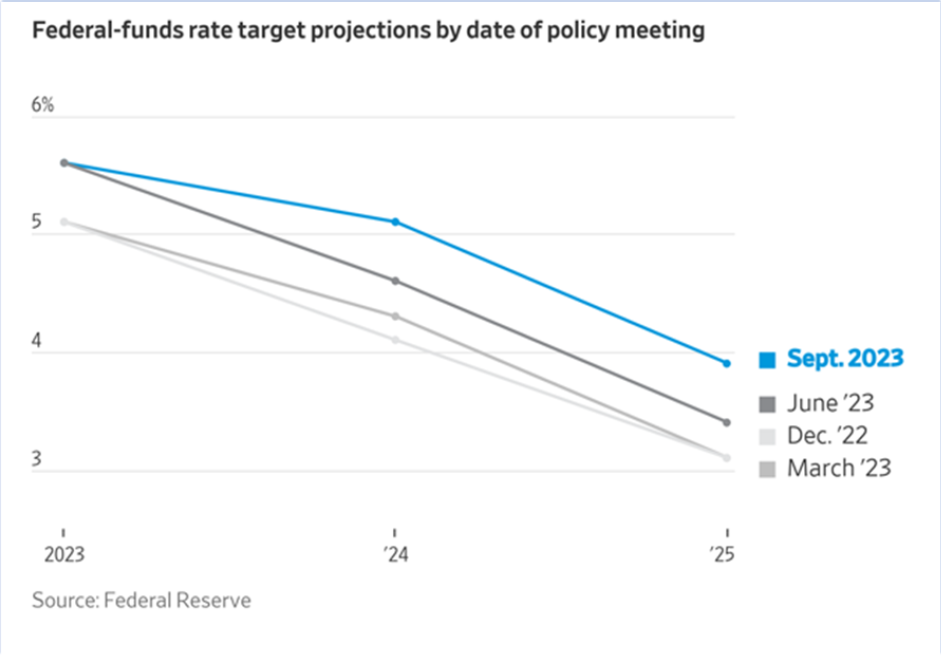

While the near term is very uncertain, we believe financial market performance will improve once the Federal Reserve signals that it is done raising interest rates. As we have discussed previously, we believe the increase in rates has caused most of the weak performance for both equities and fixed income. The policy is expected to be temporary, and its reversal should produce positive returns. The adjacent chart shows the Fed’s projections from four policy meetings over the past year. The line for September reflects the “higher for longer” policy, as the Fed is now projecting a higher Fed Funds rate for both 2024 and 2025 than it forecasted previously. However, the Fed is still projecting a decline in interest rates over the next two years. While there is potential for policy mistakes, bad forecasts, and black swan events, we are optimistic that interest rates can begin to trend lower over the near to intermediate term.

John D. Frankola, CFA Lawrence E. Eakin, Jr. Matthew J. Viverette Dylan C. T. Dunlop

Vista Investment Management, LLC is a Registered Investment Advisory firm. Under no circumstances does this article represent a recommendation to buy or sell stocks. This article is intended to provide information and analysis regarding investments and is not a solicitation of any kind. References to historical market data are intended for informational purposes; past performance cannot be considered a guarantee of future performance. Neither the author nor Vista Investment Management, LLC has undertaken any responsibility to update any portion of this article in response to events which may transpire subsequent to its original publication date.