Market Review - Fourth Quarter 2023

Equity and fixed income markets produced strong rallies in the fourth quarter of 2023 as inflation continued to moderate. The economy showed signs of slowing while avoiding a recession, the Federal Reserve signaled that it is most likely finished raising interest rates for this economic cycle, and long-term interest rates notably declined as investors anticipated an impending “Fed pivot”. Both the S&P 500 and Russell 2000 indices generated double-digit returns and had their best quarterly performance since the fourth quarter of 2020. International equities also generated exceptional returns, though not as strong as the U.S. stock market. The sharp decrease in long-term interest rates during the quarter not only contributed to equity returns, but also produced strong gains for the Bloomberg US Aggregate Bond Index, reversing a loss for the first three quarters of the year.

Equity Performance for Periods Ending on December 31, 2023

| Total Return Index | Market Sector | Quarter | 1-year | 3-year | 5-year | 10-year |

|---|---|---|---|---|---|---|

| S&P 500 | Large U.S. Companies | 11.7% | 26.3% | 10.0% | 15.7% | 12.0% |

| Russell 2000 | Small U.S. Companies | 14.0% | 16.9% | 2.2% | 10.0% | 7.2% |

| MSCI EAFE | Developed Int’l Markets | 10.4% | 18.2% | 4.0% | 8.2% | 4.3% |

| MSCI EM | Emerging Int’l Markets | 7.9% | 9.8% | -5.1% | 3.7% | 2.7% |

| BB US Agg Bond | US Investment Grd Bonds | 6.8% | 5.5% | -3.3% | 1.1% | 1.8% |

Inflation, as measured by the Consumer Price Index, is an annualized 3.1%. It has been on a steady decline since it peaked at 9.1% in June 2022. The major factors that previously contributed to high inflation—primarily stimulus policies that flooded the economy with cash and pandemic-related supply chain disruptions—have now abated. If current trends persist, it is likely that inflation will continue to recede toward the Federal Reserve’s 2% goal.

At the beginning of 2023, many observers predicted an impending recession. While the economy continued to grow, several major sectors of the economy, such as manufacturing and housing, exhibited weakness. The Conference Board Leading Economic Index has now declined for 20 straight months. Prior to this streak, every 12 consecutive months of decline resulted in a recession. However, investor consensus now appears to be that a recession is unlikely in 2024. U.S. GDP grew 4.9% in the third quarter of 2023, and full-year growth for 2023 and 2024 are forecasted by the Conference Board to be 2.4% and 0.9% respectively. A healthy labor market and surprisingly strong retail sales have continued to fuel moderate economic growth even in the face of high borrowing costs.

With inflation declining and the economy growing at a moderate pace, the Federal Reserve kept the Fed Funds target rate at 5.25% to 5.50% at its December meeting. Furthermore, the Fed signaled that it is most likely done raising interest rates and that rate cuts are probable for 2024. Equity markets rallied following the Fed’s post-meeting comments.

Favorable inflation and economic data, as well as investor optimism following the Fed’s decision not to raise rates, contributed to a sharp decline in long-term interest rates and a strong bond market rally. The yield on the 10-year Treasury Note declined from 4.57% to 3.87% during the quarter. The Bloomberg US Aggregate Bond Index, the broadest measure of the U.S. taxable bond market, generated 6.8% total returns. Lower interest rates support higher valuations for equities and were likely a primary contributor to this quarter’s stock market performance.

As we have discussed in several previous quarterly letters, one of our primary concerns regarding the U.S. stock market is the high valuation of the largest U.S. companies. Seven stocks, frequently referred to as the “Magnificent Seven”, now make up 28.5% of the S&P 500 market value. The Magnificent Seven includes Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Tesla, and Meta (Facebook). They produced an average return of 116.5% in 2023 mainly because they are considered to be the primary beneficiaries of artificial intelligence technology. The other 493 companies in the S&P 500 generated an average return of 13.7%.

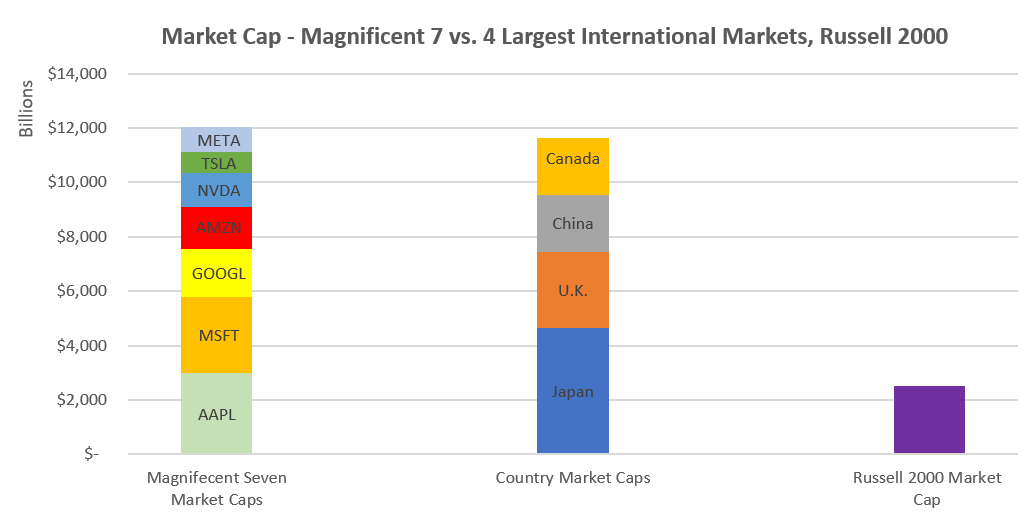

To put the market values of the Magnificent Seven into perspective, we compare them to other major markets. Collectively, the value of these seven companies exceeds the combined market value of the four largest international stock markets. And, Apple by itself exceeds the value of the entire Russell 2000 Index of small-cap companies. The following chart illustrates this visually.

The Magnificent Seven have an average price-to-earning (P/E) ratio of 32.5 times next 12-months earnings, which results in a skewed S&P 500 P/E ratio of 21.6, since the index is weighted by market value. Although this makes the overall U.S. market appear to be expensive, if one excludes the Magnificent Seven, the remaining companies have a very reasonable P/E of 17.4. While we have exposure to these seven companies in the portfolios we manage (either directly through share ownership or indirectly through funds that own them), we have been mindful of the concentration risk that they present and cautious of the hype surrounding artificial intelligence. Our portfolios are broadly diversified, which should help to limit risk if these companies experience a correction.

For the first three quarters of 2023, nearly the entire return for the S&P 500 Index was produced by these seven stocks. While they continued to perform well, we were pleased to see strong performance in the fourth quarter across the entire equity market, including small companies and international stocks.

Notwithstanding the very strong end-of-year market performance, we note that significant risks remain for investors going into 2024. While the global economy appears to be heading toward the soft landing we all wanted to see, a recession is still possible, as indicated by leading economic indicators which continue to weaken. The U.S. political environment is as contentious as it has been in recent history: with budget deadlines for a gridlocked Congress approaching on January 19 and February 2; and an upcoming presidential election where the two leading major party candidates are regarded unfavorably by the majority of voters. On the international front, there are now two unpredictable conflicts—one in Ukraine and one in Israel—and relations with China remain very strained.

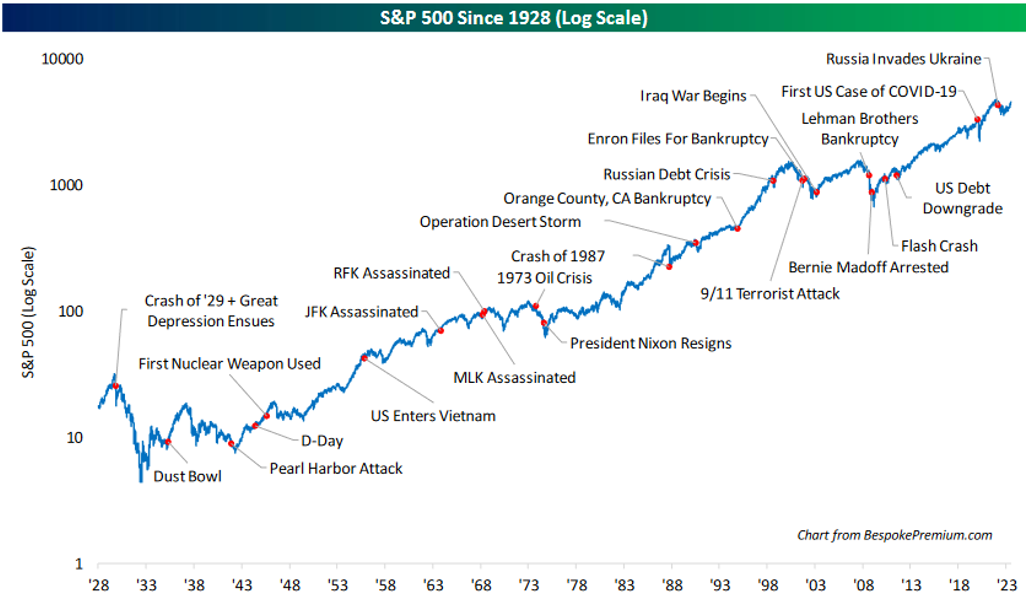

While the immediate future is uncertain, we encourage clients to focus on the long term, as the U.S. stock market has created wealth for patient and disciplined investors through wars, assassinations, global pandemics, market crashes, and crises of all kinds.

John D. Frankola, CFA Lawrence E. Eakin, Jr. Matthew J. Viverette Dylan C. T. Dunlop

Vista Investment Management, LLC is a Registered Investment Advisory firm. Under no circumstances does this article represent a recommendation to buy or sell stocks. This article is intended to provide information and analysis regarding investments and is not a solicitation of any kind. References to historical market data are intended for informational purposes; past performance cannot be considered a guarantee of future performance. Neither the author nor Vista Investment Management, LLC has undertaken any responsibility to update any portion of this article in response to events which may transpire subsequent to its original publication date.